How to Keep Your Money Safe

Photo courtesy of Sophie Maxwell.

There are a wide variety of credit cards offered, each with their own key features.

December 4, 2019

Bank accounts. How much do you truly know about them? Maybe you have one, maybe you don’t, but odds are that if you do have one, it was made by your parents when you were at a very young age. But as we grow up, the features we require of our bank accounts evolve.

Until this summer, I had only used my bank account to deposit money; I had never withdrawn. That changed when I took a summer job as a hostess.

I quickly learned when trying to cash a check that my mom had created my account when I was a baby, and as such she had control over everything. It had never occurred to us to change the account, so I was left looking stupid at the bank being told I couldn’t take money out of my own account.

Clearly that wasn’t going to fly, so when my mom got back in town, we went to the bank to change my account. It became very apparent very soon that I had no idea what I was actually going to do. All I wanted was access to my money, and now I’m being asked if I want a checking account or a savings account. Huh?

As a highschooler soon to be going into college, I realized this was knowledge I desperately needed. I can’t move out of the house with no idea what was going on with my money and where I should store it, so I did some research.

Step One: Checking or Savings?

Before you even begin looking at what bank is right for you, you first have to decide if you want a checking account, a savings account, or maybe both.

A checking account is what you need if you are planning to make lots of transactions; more plainly this one gets the bills paid. There is no limit on the amount of withdrawals you can make per month, and they generally come with a debit card. Unfortunately, though, because money is constantly flowing in and out of these accounts, they often have little to no interest on them. Put simply, interest is the amount of money the bank pays you to use their services. It is calculated as a percentage of the total amount of money in your account and then is automatically added to said account.

A savings account is used just for that: saving, so this is what you want for long term money storage. Per federal law you can generally only withdraw from this type of account six times a month without incurring a fee, so for paying the bills this is not the account for you. Because you can’t withdraw that often from it, it also does not come with a debit card, but the interest rates are often much higher than those of checking accounts. All of this is meant to help you have a safe way to save your money.

Most of the time, though, people end up with both. You never want to just be spending your money, but as we go to college and beyond, it becomes starkly obvious there’s a lot of expenses out there you have to be able to pay for at a moment’s notice. Because of this my suggestion is to first get a savings account, and then as you get older, and it’s time to go to college, start thinking about adding a checking account. You can always transfer money between the two, sometimes with a fee, sometimes without depending on the accounts and banks. If however, you are right about to go to college or the workforce, your first priority should be getting a checking account to foot the bills, and once you’ve made a little money, go ahead and open a savings account.

Step Two: Choosing A Bank

There are a lot of factors that go into choosing a bank. Just like buying a house you have to make some decisions on what features you need, which you want, which you’re ambivalent about, and which you affirmatively do not want. Everyone’s perfect plan is different, and you have to understand there will be some compromises; no plan is perfect, but in general the first and most basic things to look at are monthly fees, minimum balance required, and transactional fees. After that you have to look at the different features of the account and decide which one best suits your needs.

According to the Consumer Financial Protection Agency (CFPA), a bank cannot legally charge you with any fees that they have not disclosed to you. Because of this it is vital to understand which fees you owe, so that you can notice if something does not look right when you get your statement.

You also have to look at the locations of a bank. As a high school student, you don’t really have any idea where you will be in two, three years. Maybe you’ll still be in the Atlanta area, maybe you’ll study in Alaska. Because of this my suggestion is to go with a big bank. Go with a bank that you know has locations and ATMs everywhere, so when/if you move, you don’t have to worry about having access to your money. Once you are settled somewhere, you may find a smaller, more regional bank that suits your needs better, and then by all means switch to that bank.

I have just a few more notes on what to look for in a bank. Always always always make sure the bank is FDIC insured. What this means is that you are insured for up to $250,000 per bank account if something were to happen. I also suggest considering using the same bank as your parents. Some of them often give the children of their clients some of the percs the client gets up to a certain age.

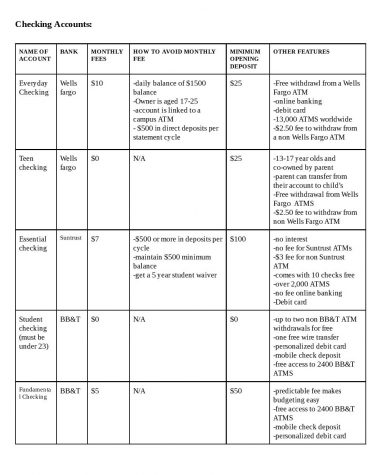

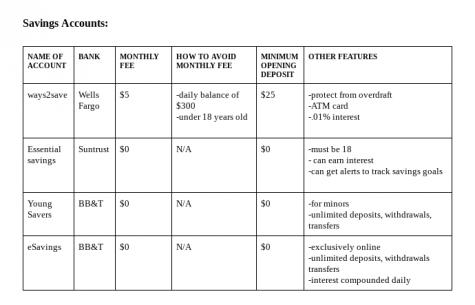

Below I have compiled just a few different checking and savings accounts to give a little insight into what the differences and similarities between the options banks have are.

Step 3: Opening an Account

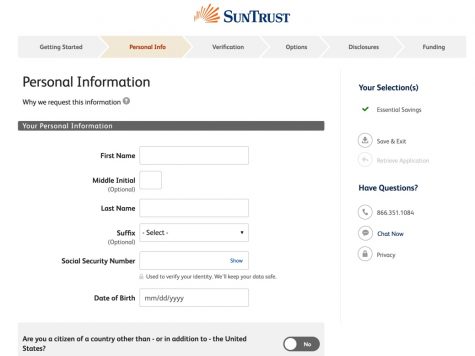

Whichever account(s) you choose, the process is generally the same. You first have to either go to the bank in person, or, if there is an option, you can also do it online. Just note that you have to give the bank very personal information, such as your social security number, so make sure you are comfortable doing that online before choosing the latter option.

In-person:

Make sure you have on your person at least two forms of ID. These can include your social security number, a driver’s license, and a passport. Make sure going in that you know exactly what account you want, but the good thing about doing it in person is that if you for some reason don’t already know, they should be able to help you (I was not very lucky with the women I worked with, but what can you do). If the account requires it, make sure to bring cash for an initial deposit. After providing them with your information they will likely give you a rundown of the account’s features and possibly even have a ‘what we covered today’ spiel.

Last but not least there are the terms and agreements. There will be multiple signatures needed, and while most of the time no one reads these, for something as important as where you money is being held, it’s in your best interest to take some time and actually read them.

The downside of in person is you can only do it during general business hours, and it is not as convenient as doing it from bed.

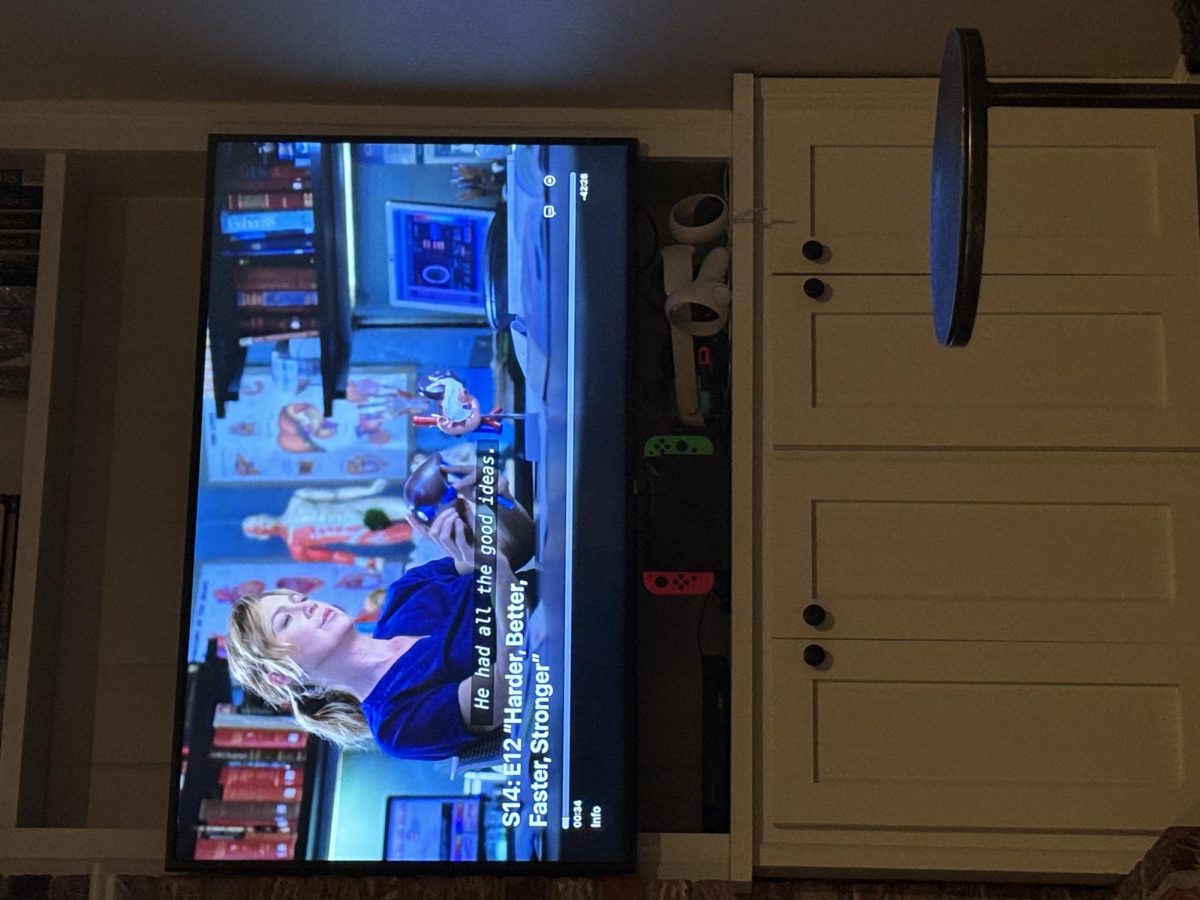

Information given to new customers after opening an account.

Online:

Online the items required are generally the same, except of course there is now no one to physically hand over your ID to and such. Instead, you will likely be given text boxes where you fill in all required information. To choose the account you will click on the one that is best for you, and then you will get to the terms. Here, again, I highly recommend you actually read them and then check the box saying ‘I agree’ just as you would any other. Some banks have online signatures with the same legally binding nature as a pen and ink one, while others may prompt you to print something out, sign it, and mail it in. In this case, the account likely will not be active until they have received the documentation.

The downside of online is no one is there to answer your questions.

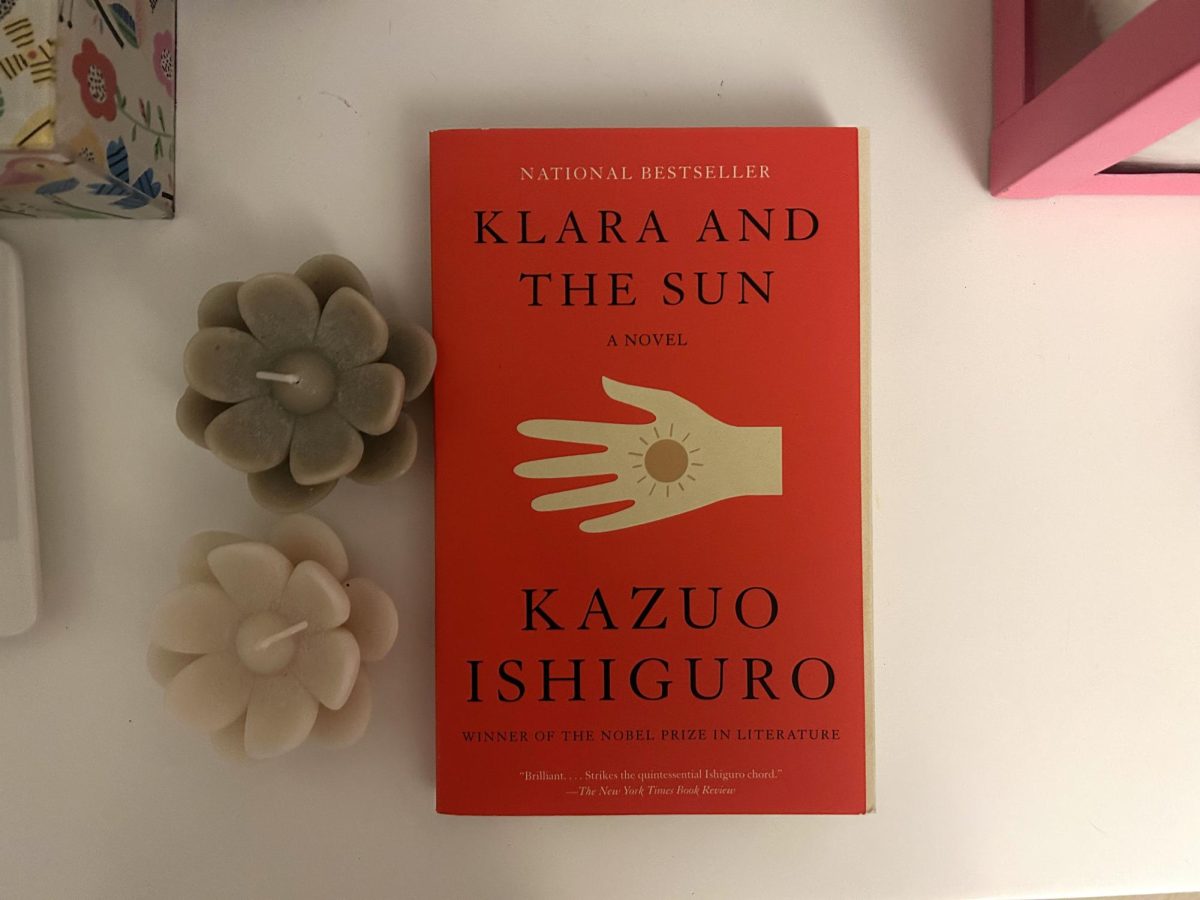

Suntrust’s online application for an account.

But if you are opening an account, know that they can refuse you. The CFPA states that a consumer can be refused an account if they “have a history of writing bad checks” or “fail to provide adequate information.” At this age, you probably don’t have a history of writing bad checks, but you might not have enough forms of identification. Please do not be surprised if they turn you away because of this.

Optional Step Four: Debit or Credit?

Often when you open a checking account you get a debit card. This is a payment option linked directly to your account. You make a purchase; the money disappears. Many ATM cards are often also able to be used as a debit card up to a certain amount.

The question then is whether or not you also want a credit card. Or two. Or three. Unlike debit, credit cards are actually just that: credit. The card provider is actually paying the stores at the time of the purchase; they have technically loaned you the money. At the end of the month you pay off all the credit you have for the provider and then you have no interest. If you don’t pay it off in full, you will have to pay interest and the faith your card provider has in you will quickly dwindle.

This is where credit scores come in to play. When applying for a card, the provider sees your score and makes a judgement on whether they want you to hold their card. If so, they might set a limit on how much you can spend, as to better ensure themselves that they will get paid back in full. This is what it means when you hear someone ‘maxed out their credit card.’

So why is this better than a debit card?

I have two reasons. The first is that there is time after purchase to find the money. The second is that, if you pay it back on time, you can earn rewards and build your score.

But be careful. It is very easy with a credit card to overspend and not be able to pay it all back. This leads to higher interest payments and a bad credit score. When trying to get a loan for a house or car later on, this score can make or break you.

These cards are provided to you by banks and then transactions are made on a payment network such as visa, MasterCard, American express. The bank you get your credit card from by no means had to be the same as the bank that you hold an account with.

It is also important to know your rights as a credit cardholder. The CFPA has a complete list of rights they believe every cardholder should be aware of. Here are a few of the most important:

- “A card issuer may not refuse you a card if you qualify” for all of their standards.

- “A card issuer cannot discriminate against you because you receive public assistance income.”

- “Generally, age cannot be used to make credit decisions; however, it may be considered in certain circumstances. For example, a creditor may use an applicant’s age as part of a valid credit scoring system.”

- “Your card issuer must give you 45 days advance notice before it raises your interest rate on new purchases.”