The Big Short Squeeze: What Happened with GameStop and How

February 14, 2021

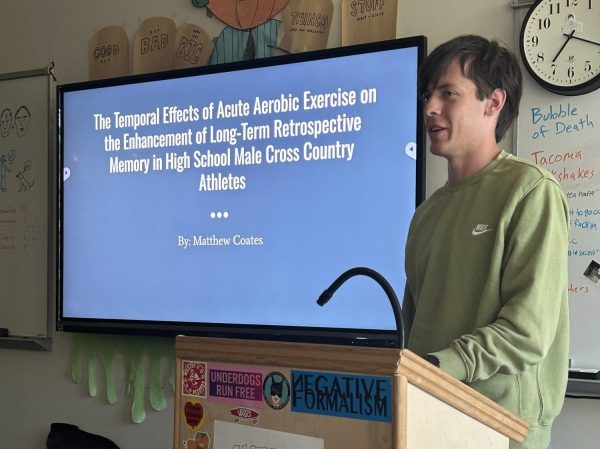

In January 2021, investors largely concentrated on the subreddit r/wallstreetbets quickly bought and drove up the price of GameStop stock (abbreviated GME) after noticing that many large investors and hedge funds had attempted to short sell more than 140% of the video game retailer’s stock. This led to billions of dollars in losses for investors hoping to “short” GME, as the stock’s closing price skyrocketed from about $15 to almost $350 in a matter of weeks, spurred on by internet fervor around the “short squeeze.” But what does any of this actually mean to someone who, like most high school students, has little to no financial expertise?

First, at the most basic level, a stock’s price, as with any kind of price, increases when there is more demand and less supply, and decreases when there is more supply and less demand. So, in simple terms, if more people want to buy a certain stock, that stock’s price goes up, and if fewer people want to buy a stock, its price goes down.

But what is a “short squeeze,” or a “short?”

“Essentially, shorting stock is just betting on the price going down. So let’s say I short sell a stock that’s $10 a share and it goes to zero, I made a 100% return. I made the whole $10. But if I shorted stock at $10, and it goes to $100, then I’ve lost 1,000%, I’ve lost 10 times my original money,” said Scott Dingman, a managing partner at the financial firm Fairfield Funding, who has more than 25 years experience with trading equity. “And that’s the danger with shorting a stock. Theoretically, your loss is unlimited. But your gain can only be the money that you use to short, your gain can only be 100% of the money that you use to short it.”

Dr. Ken Johnston, an associate professor of finance at Berry College, elaborated on the mechanics of short selling.

“[You can] borrow shares (which a broker arranges and you pay interest on the value of the borrowed shares), you sell them, then you must repurchase and replace the borrowed shares,” he said. “To open a short position you have to have a margin account, which is marked to market daily.”

Dingman also explained why short selling is often beneficial to markets and the economy.

“I’ll say there’s two things. Short sellings are a really important part of the market for professionals because number one, it uncovers a lot of financial fraud. Especially when you get big moves in equities like we’ve had in the last year. You know, from the bottom in March, you do get a lot of financial fraud and that can be uncovered by these hedge funds who do all this fundamental work, and they ferret out any kind of financial fraud. And so that’s one reason that you need short sellers in the market,” he said. “And another reason behind short sellers is when you do have a price decline, they’re natural buyers on the way down.[…] Let’s say something bad happens, and some bad news comes out and the stock’s going down. And everybody is long. Everybody wants to sell at the same time, right? There are no buyers. So if there’s a certain amount of short sellers, they have to buy to cover to exit their position. So that’s natural buying on the way down. So that’s a reason that you need short sellers.”

While the GameStop price boom was certainly unique in its execution, the actual method of short squeezing, where investors see a short occurring and buy the stock more, attempting to inflate the price, has been in use for a long time.

“Nobody’s ever seen anything like what just happened in GameStop. I mean, it’s never happened, you never had short interest that high and you’ve never had a crowdsourced short squeeze, this is the first crowdsourced short squeeze in history. With a sort of a populist movement too, that’s the thing that’s unique about it,” said Dingman. “Now, short squeezes have been around for a long time, and professionals have traded them for a long time. Professionals have gotten together as traders with each other. And we always look at short interest [the amount of stocks that have been sold short and haven’t been bought back] of a stock and then we see when the stock starts going up, if it’s got a really high short interest that actually makes me want to buy it more, because I know the shorts are going to be forced to exit their position to cover, and that’s going to make stock go hot. So this is not a new thing. Short squeezes have been around forever, and the shorts have gotten squeezed forever. You know, back in the 90s, I think it was Snapple, with a classic short squeeze. A lot of people are shorting Snapple and the stock went crazy. It went up 30 times, or something like that. But this is the first crowdsourced short squeeze, you know, using social media. That’s what’s unique about it.”

Another unique element of the GameStop short was how more than 100% of GME was shorted. This seems impossible, but due to the nature of the borrowed stocks, the same stock can be borrowed, sold, and then that person who bought the stock could lend it again, which in effect, creates two shorts on the same share of the stock, which is likely what happened with GME.

While short selling is just one of the elements of the complex nature of the stock market, Dingman sees the benefit such a high-profile stock market situation can have.

“This is a good learning experience for anybody [around high school] age, you know, to learn about the stock market. You know, this is a good education,” he said.

Johnston also offered advice, cautioning against missing the long view.

“Don’t try and play the short-term game, you will lose,” he said. “If you are going to invest in individual companies, do it based on the fundamentals of the company (expected future earnings, etc.). I suggest investing for the long term in low-cost index mutual funds.”

Now that the dust has largely settled on the GameStop short selling and subsequent short squeeze, we can learn from what happened and be more knowledgeable about one of our most impactful institutions.